What Are Separately Managed Accounts

Give your advisor access to manage your fund’s investments in order to maximize charitable impact a Seperately Managed Accounts (SMA) at GlobalTrust Funds is a flexible investment option that allows your personal advisor to provide investment services for the charitable dollars in your GlobalTrust Funds Donor Advsied Fund (DAF).

With an SMA, your Investment advisor has the ability to manage and align your personal and families financial planning alongside your charitable granting goals for one unified perspective. Overall, SMAs are best suited for philanthropist and givers who have large ongoing fund balances over $300,000 with longerterm charitable giving horizons, and the desire for their fund balance and charitable impact to grow over time.

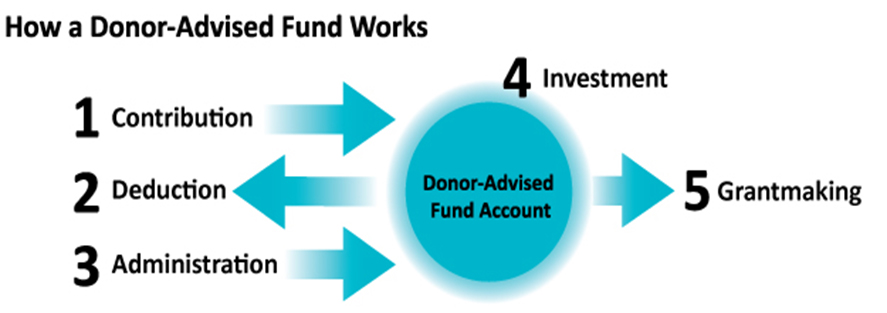

A Seperately Managed Accounts (SMA) is a Donor Advised Fund (DAF) is an account or fund with a available cash balance of $300,000 are more at GlobalTrust Funds. That you and your family have created at GlobalTrust Funds as a sponsoring organization as a qualified public charity. You make irrevocable gifts of cash or other assets to the fund, and you receive an immediate charitable income-tax deduction.

The (SMA-DAF) is not part of your estate for gift and estate tax purposes. The (SMA-DAF) can sell the assets you contribute, including highly appreciated stock, without triggering capital-gains tax. It can then reinvest the untaxed proceeds in a diversified portfolio, and benefit from its tax-free growth and income.